Kit Rutherford and Tim Cox are modelling a market where the currency is nitrogen exports and the commodity is clean water.

PDF of this article (193 KB)

There’s a lot in the news about emissions trading schemes. For more than a decade the individual transferrable quota (ITQ) system has been used in New Zealand to help manage marine fisheries. Current discussions are about trading schemes for carbon to help meet New Zealand’s obligations under the Kyoto Protocol, for water to help optimise irrigation, and, most recently, for nutrients to help minimise the impact of pastoral farming on water quality. How might nutrient trading schemes work, how will they improve sustainable management, and what are their potential shortcomings?

Scientists at NIWA are working with Motu Economic and Public Policy Research in nutrient trading projects for Taupo and Rotorua, two places where regional government has decided to reduce nutrient inputs to the lakes in order to maintain or improve water quality. Environment Waikato and Environment Bay of Plenty have targeted ‘manageable’ nutrient loads, which excludes natural sources. The proposed nutrient trading schemes at both sites are similar in concept to the fisheries ITQ system, but they differ in detail. Both schemes are based on ‘cap and trade’ and rely on the widely used Overseer® model to determine how much nitrogen is leaving farms. As part of a collaborative study, NIWA scientists have created the computer model N-Trader to simulate the nutrient trading market.

How does a ‘cap-and-trade’ scheme work?

All cap-and-trade schemes follow these basic steps:

- Define the ‘cap’ – here the nutrient load that maintains lake water quality.

- Define the ‘players’ in the market.

- Allocate the ‘cap’ amongst players – these allocations become the ‘allowances’.

- Trade ‘allowances’ – this involves having a market place and setting a price.

- Monitor compliance.

The similarities and differences between the two schemes at Taupo and Rotorua are shown below.

| Lake Taupo | Lake Rotorua | |

|---|---|---|

| Cap | Constant – current nitrogen export from farms | Decreasing – nitrogen and phosphorus inputs to the lake |

| Players | Pastoral farmers and the Lake Taupo Protection Trust | Major landowners |

| Initial allocation | Grandparenting | Undecided |

| Market place | None | Undecided |

| Monitoring | Overseer® | Undecided |

Trading nutrient inputs to Lake Taupo

Recent decisions by the Environment Court have cleared the way for a cap-and-trade scheme to be implemented at Taupo. The target has been set to reduce the nitrogen load by 20%. Farms occupy only 18% of the land but contribute more than 90% of the manageable nitrogen input to the lake. The intention is to allow nutrient trading at Taupo.

The ‘players’ in the Taupo market are farmers and the Lake Taupo Protection Trust, but not foresters or lake-side communities. Community sewage will be controlled outside the market. Forestry companies are excluded from the market because exports from forestry are similar to the natural and uncontrollable exports from native forest and scrub. The Trust administers an $81.5 m fund to protect lake water quality, and will stand in the market to purchase nitrogen discharge allowances (NDA) and/or farmland.

The initial allowances are being allocated based on documented stocking rates, meat and wool production, fertiliser use, and other parameters, during a five-year window and using Overseer® to predict nitrogen exports. When this process is completed, each farmer will have a consent which details their NDA – a fixed amount expressed as tonnes of nitrogen per year (tN/yr).

From year to year, farmers can alter how they farm, provided their nitrogen export (as predicted by Overseer®) does not exceed their NDA. If a farmer wants to increase production, they must purchase NDA from another farmer who wants to decrease production. Once a trade has been agreed between two farmers, each of their consents is adjusted to increase or decrease their NDA.

From year to year, farmers can alter how they farm, provided their nitrogen export (as predicted by Overseer®) does not exceed their NDA. If a farmer wants to increase production, they must purchase NDA from another farmer who wants to decrease production. Once a trade has been agreed between two farmers, each of their consents is adjusted to increase or decrease their NDA.

Trading nutrient inputs to Lake Rotorua

At Rotorua, a stakeholder working group has discussed a cap-and-trade scheme and research is underway to fine-tune the scheme by investigating market efficiency, trading price, monitoring and administration costs, and the impact on the local economy.

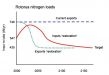

The target set by Environment Bay of Plenty is to reduce lake inputs to 435 tN/yr – the input during the early 1960s before there was widespread concern about algal blooms and deoxygenation. In 2005, total land exports were 746 tN/yr and lake inputs were 547 tN/yr; the 199 tN/yr difference arises from groundwater lags and attenuation. A substantial reduction in exports is required to attain the lake input target, and this is likely to be phased in gradually over a number of years.

In Taupo groundwater lags were ignored and the cap was fixed, so allowances do not vary with time. Rotorua differs from Taupo in that the cap will decrease over time and it is intended to include groundwater lags. A decreasing cap, and groundwater lags, can be accommodated by issuing allowances with different ‘vintages’. The vintage specifies when the nitrogen reaches the lake (see box, below). The market then trades different vintages, which is feasible but complex, and has similarities to a futures market.

Research has been commissioned to inform the design of nutrient trading schemes in New Zealand using Rotorua as an example. The work is funded by FRST and Environment Bay of Plenty, and is spearheaded by Motu, a not-for-profit organisation with a long history of providing policy advice to central and local government. NIWA’s new N-Trader model will be used to simulate a nutrient trading market. GNS Science provides information on groundwater lags.

Modelling nutrient trading with N-Trader

The N-Trader model has a biophysical component that predicts nutrient exports from each farm using Overseer®, and then simulates attenuation and groundwater lags. N-Trader also has an econometric component that predicts the price at which nitrogen is likely to be traded, and how price is likely to affect land-use. This component is based on an existing Motu model which relates changes in land-use over the last 20 years to changes in commodity prices and interest rates.

In the first year of the study we developed and tested a protoype N-Trader. Over the next two years we’ll use the model to investigate the effects of changing commodity prices, farming practice, nitrogen-mitigation measures, and the size of the cap on the behaviour of farmers, changes in land-use, and impacts on the local economy. It will also be used to investigate different options for nutrient trading schemes at Rotorua and elsewhere in New Zealand. Our results will help identify the strengths and weaknesses of nutrient trading schemes. Some advantages and disadvantages are already apparent, and this project will explore these in more detail.

Vintage groundwater

To accommodate groundwater lag in nutrient trading schemes, models can incorporate the water’s ‘vintage’. For example, in order to farm in 2000, Farmer A in a 50-year groundwater lag zone would need to hold allowances of vintage 2050, whereas Farmer B in a 25-year lag zone would need to hold allowances of vintage 2025. Farmer A could reduce production in 2000 and sell his 2050 vintage allowances to Farmer B, who would hold them for use in 2025. If the cap decreases over time, then the total number of allowances would be higher for 2025 vintage than 2050 vintage.

Trading in a watery market

- Regions are setting limits (‘caps’) on how much nutrient farmers are allowed to discharge into New Zealand lakes.

- ‘Cap-and-trade’ schemes let producers buy and sell discharge allowances.

- The new N-Trader model simulates the market response to nitrogen emissions trading.

Dr Kit Rutherford and Dr Tim Cox are catchment modellers at NIWA in Hamilton.

N-Trader draws on expertise from Motu Economic and Public Policy Research and GNS Science. Funding comes from the Foundation for Research, Science and Technology and Environment Bay of Plenty.