Overview

From a financial performance perspective, NIWA has had a slower than expected start to the financial year, and at the half year stage is below its budgeted revenue and profit. This is largely due to the impacts of COVID-19. Nevertheless, NIWA expects to recover much of the revenue shortfall to date and, together with tight control of costs, expects to meet its budgeted profit for 2021/2022. This assumes no major COVID disruption to science delivery.

All the science and support performance indicators outlined in the 2020/2021 Statement of Corporate Intent are on track. Significant progress has been made on NIWA’s Future Property Programme with the building of the Hamilton offices now well underway, the design of a replacement vessel for RV Kaharoa is now complete and the build process is expected to commence in the third quarter and build of the experimental commercial-scale recirculating aquaculture system for the culture of high-value finfish is underway.

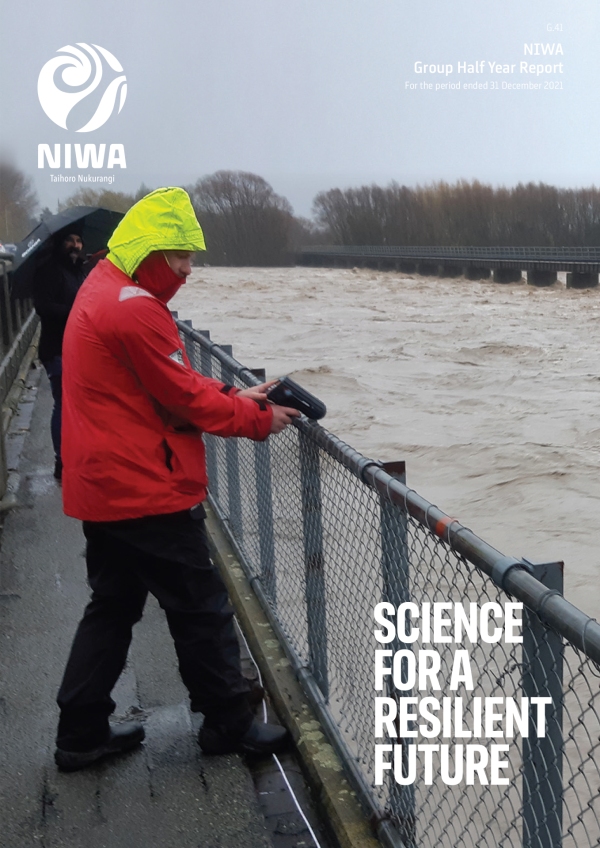

A number of significant science advances were achieved over the past six months, as outlined in this report. These include progressing commercial production of kingfish, new environmental forecasting services in the Pacific, supporting emergency response during flood events, development of a programme to grow Maori research talent, completing fisheries vessel-based surveys despite COVID-19 challenges, progressing a pan-CRI initiative to provide a single portal for access to all CRI environmental data, and researching ventilation in schools to minimise the spread of COVID-19.

Download the Half Yearly Report for the period ended 31 December 2021 [PDF 4MB]

Financial results

NIWA has had a challenging start to the financial year with some impacts felt from the COVID-19 lockdowns, achieving revenue of $76.8M in the first six months. This result was $4.4M below budget and $9.3M below the same period last year (which included COVID-19 Response and Recovery Funding of $8.3M). Helping to offset the impact of lockdowns, NIWA’s largest ocean-going research vessel, RV Tangaroa, was at sea for 27 days more than budgeted during the period.

Total expenditure of $79.5M was $1.9M lower than budget, however this was offset by the below budget revenue, resulting in a loss before tax result of $(2.8)M, compared with a budgeted loss before tax of $(0.2)M. Loss after tax for the six month period was $(2.0)M, compared with a budget of $(0.5)M.

The closing cash balance and short-term investment balance of $59.1M was $16.1M above budget as cash continues to be carefully managed to ensure that NIWA’s planned strategic investments are not put at risk. The cash balance has decreased by $2.9M during the first half of the year due to capital spending being higher than operating cash flows from profit and working capital management.

Capital spending for the period was $13.3M against a budget of $21.3M. The variance was due to differences compared to budget assumptions in the timing of investment spending during the year.

NIWA is continuing to pursue revenue opportunities in order to meet the full-year revenue budget. Notwithstanding the year to date shortfall, NIWA expects to meet the budgeted profit result for the year through continued careful management of costs and provided no significant project delays occur. We note, however, that significant headwinds continue to be seen in the market for commercial work. This will continue to be an area of focus for NIWA’s management and Board so as to mitigate risks to revenue in FY22 and beyond.